What is USDF

USDF is the banking industry’s answer to the need for a digital dollar.

Blockchain technology can make payments more efficient and improve traditional banking services, expanding access to safe and affordable financial services.

USDF is a “tokenized deposit” that represents an existing bank deposit on a blockchain ledger. By extending the existing banking model onto blockchain we can deliver modern payments infrastructure while maintaining the numerous protections and benefits that our two-tier banking system provides today.

Our Members

What is the USDF Consortium?

The USDF Consortium is a membership-based association of insured depository institutions. Our mission is to build a network of banks to further the adoption and interoperability of a bank-minted tokenized deposit. The Consortium’s founding bank members include New York Community Bank, NBH Bank, FirstBank, Webster Bank, and Synovus Bank. Figure Technologies, Inc. and JAM FINTOP are also founding members and will facilitate and promote the adoption of USDF.

USDF Faqs

What is USDF?

USDF is the banking industry’s answer to the need for a digital dollar within a modern, efficient banking environment that will increasingly rely on digitalization of payments. Blockchain technology can make payments more efficient and improve traditional banking services, expanding access to safe and affordable financial services.

USDF is a “tokenized deposit” that represents an existing bank deposit on a permissioned blockchain ledger. By extending the existing banking model onto a permissioned blockchain, banks can deliver modern payments infrastructure while maintaining the numerous protections and benefits that our banking system provides today.

What is the USDF Consortium?

The USDF Consortium (the “Consortium”) is an association of federally-insured banks, along with Figure Technologies, Inc. and JAM FINTOP Networks, LLC. The Consortium’s mission is to build a network of banks to further the adoption and interoperability of tokenized deposits. The Consortium’s founding bank members include New York Community Bank, NBH Bank, FirstBank, Webster Bank, and Synovus Bank. Figure and JAM FINTOP are also founding members and will facilitate and promote the adoption of USDF; however, as they are not federally-insured banks, these fintech companies are lending their considerable technical expertise, and separately their services, to the Consortium and will not create or issue tokenized deposits.

Why blockchain?

Safe and secure tokenized deposits enable faster and cheaper payments. Tokenized deposits are also programmable, allowing for complex transactions to be executed quickly and accurately. Among other things, blockchain technology can deliver:

- Controlled access to trusted participants (i.e., federally-insured banks);

- 365/24/7 operating hours (distributed ledger technologies are “always on,” while account-based banking systems are not);

- A single source of truth replaces siloed ledgers across firms;

- Programmability (smart contracts deliver new forms of automation, such as by allowing parties to automate the purchase and sale activities alongside the related payment activities in various types of on chain transactions); and

- Instant settlement reducing counterparty risks (reducing settlement times from days to seconds).

What sets USDF apart?

USDF is a collaborative effort to build a modern, permissioned blockchain-based tokenized deposit. While there are a number of different blockchain and crypto initiatives being undertaken by banks, USDF is unique in a number of aspects:

- Real-world value: USDF is focused on bringing blockchain innovation into everyday consumer and commercial transactions by leveraging blockchain technology to improve traditional banking services. Unlike other initiatives, we are not focused on building connectivity into the non-bank crypto ecosystem to facilitate speculation and arbitrage unrestricted by appropriate guardrails.

- Permissioned Ledger, Open Platform: USDF is an open platform to members and participants for innovation. Federally-insured banks that are members of the USDF Consortium have the freedom to use the USDF smart contract to power any application of their choosing and can elect to integrate to the chain through any vendor they choose via open-source code. Banks would not need to hire a third-party vendor to implement or engage with USDF.

- Interoperability: The Consortium was founded to provide a forum for banks to come together and discuss common standards for blockchain-based payments. Today we see the development of many closed-loop systems that struggle to talk to each other. Without interoperability, these systems will never deliver the promise of more efficient payments.

- Supports Credit Creation: USDF allows banks to implement blockchain technology while ensuring banks can continue to leverage deposits to help make credit available in their communities.

- Bank Owned: The USDF Consortium is primarily owned by banks, and is subject to supervision and examination by its bank members’ primary federal regulators, as provided by applicable law and set forth in the Operating Agreement of the USDF Consortium LLC.

Does USDF compete with CBDC?

USDF is one form of a digital dollar that allows banks to extend the existing banking model onto a permissioned blockchain. USDF presents an alternative to retail non-bank digital money like stablecoins, which lack bank-level risk management and other safeguards, or a retail CBDC models, which would move deposits off bank balance sheets and eliminate banks’ ability to create credit. USDF complements improvements in wholesale payments such as FedNow, RTP, and potentially a wholesale CBDC.

Who can use USDF?

USDF will be controlled exclusively by insured depository institutions supported by qualified service providers. USDF will help facilitate faster, cheaper payments for banks, including with respect to underlying customer activity, although customers will not interface with USDF, just as they do not directly interface with other clearing or settlement rails (e.g., Fedwire). Value underlying USDF transactions will settle into traditional deposit accounts.

What blockchain will USDF operate on?

USDF will operate on a private, permissioned blockchain that is constructed (and maintained) based on the underlying code of the established and well-functioning Provenance Blockchain, but will be walled off from the permissionless Provenance chain in order to ensure safe operation within bank regulatory compliance parameters. This allows banks to leverage the benefits of a shared ledger while maintaining privacy and ensuring that only insured banks (i.e., BSA regulated financial institutions) can participate in USDF transactions, including as validators. The USDF Consortium will contract with a pool of trusted validators to operate the permissioned chain.

How can banks participate in USDF?

Banks can participate in USDF in several ways:

- Member: FDIC-insured banks can connect with peer banks to develop blockchain strategy, upskill staff through participation in working groups, and engage in industry advocacy.

- Owner: Owners of the Consortium are working together to build common infrastructure to support USDF payments. This includes access to common infrastructure and shared legal resources related to the implementation of tokenized deposits.

____________

* Joining the consortium does not commit a bank to operating on the USDF Consortium’s network. Before a bank may participate in actual minting, transferring, or burning of USDF tokenized deposits it will be required to sign a participation agreement binding it to the Consortium operating rules.

Will USDF require regulatory approvals?

Today all banks are required to obtain prior non-objection or similar regulatory approval before engaging in blockchain-based payments activities. USDF was built from within the bank regulatory perimeter and is designed to meet banking agency expectations. We are committed to working with the banking agencies to ensure they are comfortable prior to moving forward. As with any innovative technology, the Consortium has a product development roadmap. The Consortium is committed to socializing and, where appropriate, supporting member banks in seeking any necessary approvals from regulators for material changes to its initial model.

(Initial conceptualizations for the USDF model contemplated that USDF tokenized deposits would be made available directly to bank customers for them to hold in individual wallets with access managed by the banks; however, the Consortium has redirected its initial attention towards the current bank-to-bank model, where USDF will be held in participating bank wallets and moved to and from Consortium banks on behalf of their customers. The Consortium and individual banks would seek regulatory non-objection before returning to any customer-to-customer model.)

What are the Gates and Guardrails?

We plan to take a phased approach with USDF that will allow banks and regulators to understand and get comfortable with this new use of blockchain technology. Although USDF does not present the same risks present in the non-bank crypto ecosystem, this phased approach can help prove the resilience of our approach while giving banking agencies and other stakeholders transparency and ensuring comfort with every step. We anticipate that each evolution of the above-described model will necessitate regular regulatory engagement.

Initial tests will consist of limited scale pilots. These tests will include intrabank transactions to test functionality from within an institution as well as limited interbank transactions.

(Using the initial customer-to-customer model, two of the Consortium banks already have successfully tested their ability to move USDF tokenized deposits on chain, contributing important foundational support for elements of the bank-to-bank model currently envisioned by the Consortium.)

How do USDF transactions operate

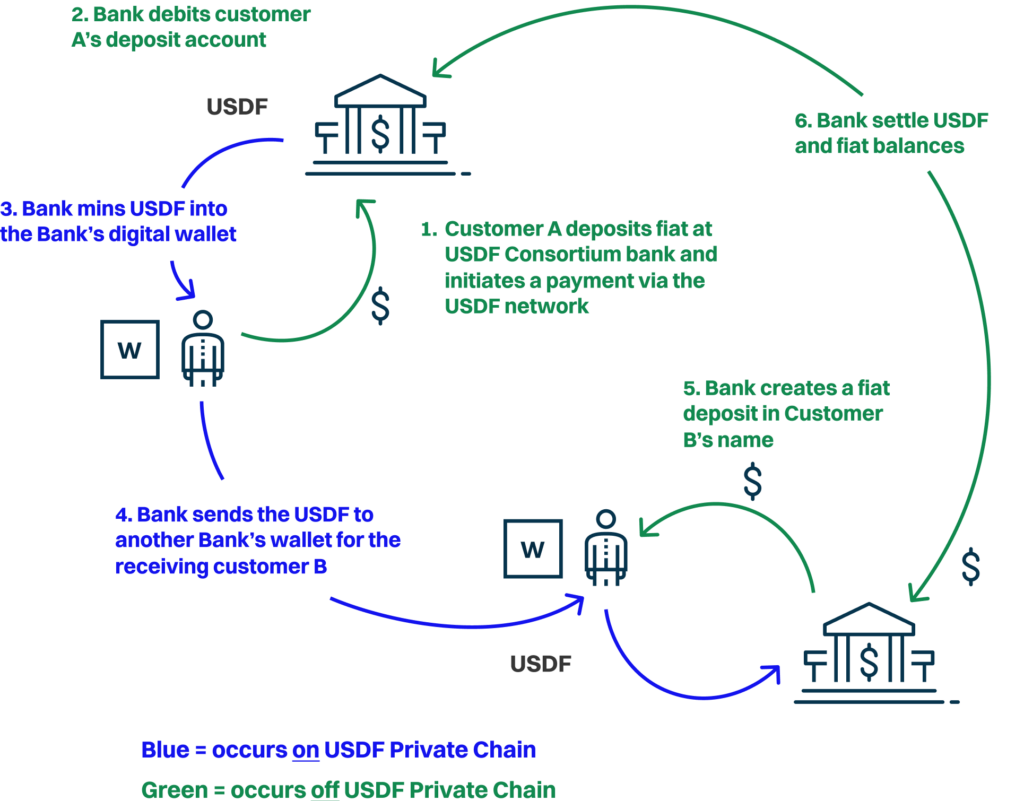

Illustrative Deposit Tokenization via USDF

- Each USDF Consortium bank will have a digital wallet on the Provenance Blockchain for transacting in USDF on behalf of its customers.

- A customer wishing to transact via the USDF network will be onboarded in accordance with their bank’s standard account-opening procedure. The customer will be able to initiate a transaction via the USDF network through their online/mobile banking interface.

- When a customer instructs its bank (“sending bank”) to send money to a customer of a USDF Consortium bank (“receiving bank”), USDF is minted by the sending bank, the sending bank will debit funds from the sending customer’s deposit account and credit a USDF settlement account at the sending bank.

- When the receiving bank receives the USDF and credits its customer’s bank account with deposits, the receiving bank records a debit in its USDF settlement account, reflecting the funds due to it by another bank.

- At the settlement time(s) each day, the USDF Consortium generates a net settlement report indicating each USDF Consortium bank’s net settlement position relative to each other USDF Consortium bank. USDF Consortium banks then settle their net obligations over Fedwire Funds or FedACH and update their books and records accordingly.

Our Board Members

Rob Morgan

Chief Executive Officer

Aldis Birkans

Chief Financial Officer

NBH Bank

Ashley Harris

Advisor

Figure Technologies, Inc.

Andrew Kaplan

Executive Vice President & Chief Digital Banking and BAAS Officer

New York Community Bank

Siya Vansia

Chief Brand & Innovation Officer

ConnectOne Bank

R. Wade Peery

Chief Administration Officer

First Bank